Your Investment Risk Tolerance

So now you are at the crossroads, you know you must take control of your money and your overall financial situation.

You have reviewed your finance, you know exactly how much your estate is worth, you have done your budget and set your financial goals, you know what investment strategies are the best to improve your tax position, your income, your government benefits, you have figured out if investing in super, outside of super or a combination is the way to reach your financial goals so now is the time to decide on your investing strategy.

But before you jump into making any investment decisions, you need to understand the investment risk, which is an essential step in developing your investment plan.

And this is what we are talking about today, what actually is investment risk and why it is so important to understand it before you start investing.

In financial terms, risk is that the outcome of your investment might be different to what you set out to achieve or what investment return you expected to receive.

Talking about the rate of return, there is a close relationship between risk and return.

As a general rule, the higher the expected return on an investment, the higher the risk of the investment. And then, the opposite it true as well, the lower the expected return, the lower the risk. Lower risk means the returns are more stable and there is a lower chance you could lose money.

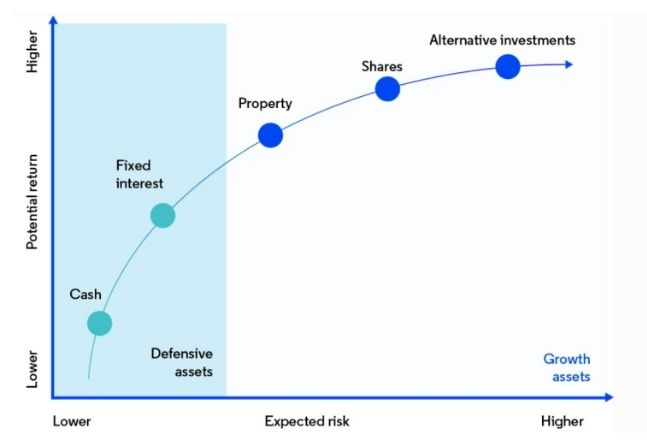

This is a great graph that I found on ASIC website that clearly explains the relationship between investment risk and reward.

The vertical line shows us the level of return, while the horizontal the level of risk.

As you can see on the graph, the lowest risk is when your money is invested in cash, but at the same time, this is where you get the lowest return. Check how much your bank is paying you today for keeping money in the savings account or your deeming account or even your term deposit. Close to nothing, but there is also a very little chance of you losing any of that money.

So if you want a return that is greater than cash, you need to climb up the vertical line, as you can see we have no choice but to increase the risk by investing through fixed interest, property, shares and alternative investments.

Unfortunately, there are no investments that will provide high returns at low risk.

But do you know what the biggest financial risk is?

The biggest risk of all is not investing at all. Keeping money in cash long term is a sure way to never get ahead, as your money cannot even keep up with inflation. We will discuss it in more detail in another video.

So now that you know what investment risk is, you need to figure out your own risk tolerance.

Your risk tolerance is your ability to cope with falls in the value of your investment, so the risk levels you are willing to take to reach your financial goals.

There are many factors that may influence your risk tolerance

- your age,

- your capacity to recover from financial loss such as investment time-frame, ability to save, reliance on existing capital

- your financial goals

- your health and

- your knowledge and investing experience

When I see clients who ask me to assist them with investing decisions or creating an investment portfolio, I need to understand each person’s risk tolerance and to do this, every person needs to answer number of questions that in combination will give me a clear indication as to each person’s risk tolerance.

But how do you figure this one out by yourself?

One of the ways is to ask yourself:

- What would I do if the value of my investment dropped by 20% tomorrow?

- How would I feel?

- How much would that worry me?

- What would my reaction be?

If you are unsure, go back in time only two years ago, March 2020, beginning of covid, when markets across the globe reacted severely to the terrible news with incredible losses basically within days.

Do you remember what happened to your super savings? How much did your super reduced in value? What did you do then? Did you panic? Did you sell your investments and hide money in cash? Or you decided to wait it out, knowing that markets recover overtime, that those market movements are part of the deal? Or maybe you took advantage of those falls and you invested more money?

As you can see each person can react differently, but if you analyse your past reactions, this will give you a very good indication as to what level of risk you are willing to take and you will understand your risk tolerance.

If such drops cause a great deal of worry that you decide to withdraw your money, you really should keep your savings in a very low risk assets, but as a consequence, unfortunately do not expect high level of returns.

As I said before, there is no such thing as investments that provide high returns with low risk.

Another question you can ask yourself is: what is more important:

- having a comfortable, low volatility and low risk returns, although there is a big probability of not reaching your goals

- or reaching your goals is much more important even if that means some volatility along the way

If your answer is:

- I don’t want my investments to be volatile, it worries me to see my returns going up and down, so I’d rather not reach my goals then to go through those volatile returns. It tells you that you are a very conservative investor.

- If on the other hand, reaching your financial goals, that are really your life goals is more important than going through market volatility over shorter terms, and you know you don’t panic, you don’t participate in mad selling when markets drop, but you patiently wait for market recovery, or you do your research and your due diligence to confirm if your portfolio needs to be adjusted in any particular way due to those market changes, then your risk tolerance is much greater and you can create your investment portfolio according with that risk profile in mind with exposure to assets, which are higher risk but provide also higher returns over longer investment term.

The emotional drama in most cases comes from lack of understanding and lack of experience. The more you understand investing and market behaviour, the higher the risk you are willing to take.

The truth is that smart investing is not about taking crazy risk, on contrary, it is all about:

- risk mitigation,

- correct diversification,

- sufficient research,

- consistency of ongoing reviews and necessary adjustments to your investment plan.

There is not one person on this planet that can avoid negative returns, which are part of investing experience, but there are plenty of ways to reduce a degree of risk taken to reach your goals.

So read books, learn from professionals, or ask for the advice to assist you in understanding your risk tolerance, to build an investment portfolio that is designed to reach all those life goals you dream about and to have an ongoing advice and support to make those investment adjustments when necessary.

I hope you enjoyed our today’s discussion about investment risk and the information presented is helpful. However, if you prefer to receive a professional advice how to set up and manage your investment portfolio according with your own risk tolerance profile, contact me to discuss.

Remember that Retirement is a Journey not a Destination, so be well prepared for this Ride.

By: Katherine Isbrandt CFP®

Money Strategist & Retirement Planner

Principal of About Retirement