Labor tax cuts – who benefits the most

Politics is an amazing beast, and we all have love/hate relationship with it. But regardless of your feelings towards politics, political parties, or political leaders, we are all impacted by government decisions which have a profound impact on our lives, and most certainly on our financial outcomes.

So, even if that does not interest you, or you disagree with the proposed changes, you need to stay alert, aware and analyse what is your benefit, if any, how the change will impact you and what can be done to improve financial outcomes for you, your family and your financial future.

And today we are discussing one of such topics, Labor’s proposal of new stage 3 personal income tax-cuts for 2024/25 financial year.

If you are not sure why I am referring to, go back to those articles:

- 4 tax benefits from Federal Budget 2020,

- Federal Budget 2020-21 for pre and post-retirement,

- Federal Budget 2022.

The last two explain the stage 3 tax cuts as per original and already legislated changes that are due to be introduced on 1st July 2024.

But now surprisingly Labor came up with a new proposal of their own tax cuts and the opposition is furious saying that Prime Minister is breaking his electoral promise of not making any changes to those legislated new tax rules.

Labor however says that due to high inflation and increase in cost of living, they want to introduce a better version of tax cuts whereby majority of Australian taxpayers will benefit, and that this is a plan for middle Australia.

So let’s put the figures into the test and you can be the judge if the new, recommended rates are better than those originally introduced and legislated and by how much.

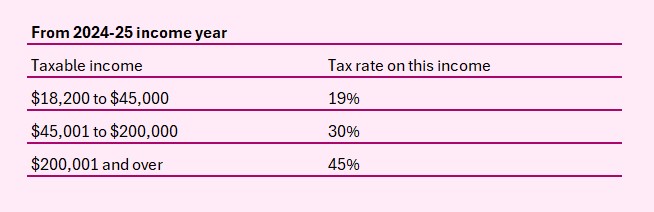

This is the table of tax cuts already legislated:

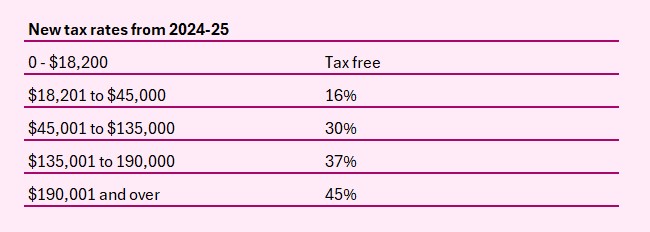

This is a table of new, recommended tax cuts:

So at the first glance, do you think you will be better off with those already legislated, or those just recommended by Labor tax rates?

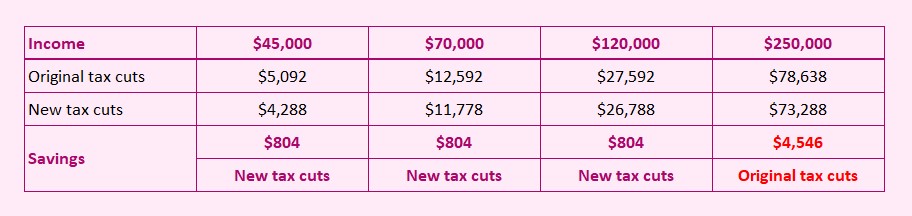

Let’s check few examples to put this into perspective:

Income of $45,000pa gross.

Based on the legislated tax rates the first $18,200 is tax free and the balance above will be taxed at 19%, therefore tax payable is $5,092.

Under the new Labor proposal, the tax-free threshold is unchanged, however the balance above $18,200 is to be taxed at 16% rather then 19%. Therefore, now the tax payable is $4,288 providing a tax saving of $804pa.

You might say, this is good, more money in my pocket, but let’s check what happens to higher incomes:

What Labor has done is reduce the tax rate for those earning up to $45,000 from 19% down to 16%.

In comparison to the original and legislated plan, as per my table below, this is the saving of $804pa.

Therefore, exactly the same level of saving continues to all incomes up to $135,000.

Then Labor wants to keep 37% for incomes above $135,000 up to $190,000 with 45% tax rate above.

In comparison, the legislated system was providing 30% tax rate for all up to income of $200,000 with 45% payable above that level.

Considering that we are talking about $804 saved as a maximum for all earing up to $135,000, is this really a tax-saving worth talking about?

I am not criticising any tax savings, we all love to save on tax bill, but I am just shocked how insignificant those tax cuts are in comparison to the legislated tax rates, and I am questioning what cost was spent by the government to come up with this proposal.

Prime Minister calls this a fair and beneficial tax cuts for most Australians.

Interesting facts:

- The median income in Australia is $59,000

- The average income in Australia is $79,000

- 80% of Australians earn less than $110,000

Therefore 80% of Australians will save $804pa under this new proposed tax cuts, but I don’t think this will help a great deal with the rising cost of living and high inflation, and this is exactly how this budget is being advertised.

But if you are only working part-time on $20,000. Where is the saving for those people? Measly $54.00

If our government really cared about people on low and middle incomes, it is easily done:

- An increase of the tax-free threshold would assist those on lowest incomes. After all we had no change of tax-free threshold since 1 July 2012, that is 14 years of the same threshold.

- What’s worse, the small assistance that existed in the form of the LMITO – the Low- & Middle-Income Tax Offset was removed in 2022/23 financial year.

So, where is that assistance for middle Australia?

By: Katherine Isbrandt CFP®

Money Strategist & Retirement Planner

Principal of About Retirement