How superannuation impacts our retirement

Financial planning these days covers an incredible amount of information from tax, through investments, retirement, insurance, Aged Care, Age Pension, assets longevity, portfolio creation and many, many more, so my goal is to cover as many topics as I can, but at the same time, I want to keep my articles interesting, vivid, and informative.

I found this amazing article explaining impact of superannuation on our retirement outcomes, so I thought I would share the main findings with you.

Therefore today, we will discuss how superannuation has changed the way we derive our income in retirement and exactly how retirees depend on their income streams in retirement.

Introduction of the superannuation system in Australia has an incredible impact on our financial outcomes.

Not only it is compulsory, so it is your employer’s responsibility to pay for it, but then you have all those tax benefits that just tease you to continue putting more and more to super. Why? Because you can save on tax, and who likes to pay taxes?

Most people will do anything not to pay taxes, so we buy the whole concept of contributing extra to super. And it is fantastic, we pay lower income tax, we save more in a concessionally taxed environment. So we love the idea.

And so does the government, as in many cases, people will cancel themselves out of the Age Pension system, saving the government billions in payments.

Retirement income these days is mostly from the superannuation system, as a matter of fact over 1 million Australians were dependent on their super pension payments in 2020. Surprisingly around 75% of households living off their super savings had less then 20% of their income from the government pension.

In 2021-22 there was over $59bil in various income streams providing payments to retirees.

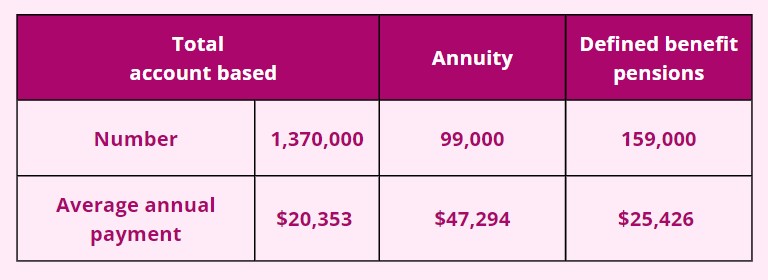

An interesting statistic for you from APRA Annual Superannuation Bulletin:

In 2021-22 there were 1.3 million Account Based Pensions paying an average income of $20,353.

We had 99,000 annuities with an average annual income of $47,294. It actually surprised me to see more than double annual payment size from annuities in comparison to Account Based Pensions.

What that indicates is that majority of those annuities are of a considerable original investment balance, only proving that wealthy families find a great deal of benefit in annuities.

And I am not surprised, I have been talking about annuities many times on this channel, so if you are not sure what benefits can annuities provide to you, read:

And then there were 159,000 defined benefit pensions of an average annual income of $25,426.

Over 330,000 people are receiving an income stream from their SMSF with an average income of $47,900pa.

What surprised me the most is the statistics that prove that in most cases retirees draw down the full value of their pension accounts during their lifetime rather then leaving a substantial amount for a spouse or children. What that indicates is the fact that we live longer, and we want good quality of life.

I think every retiree worked hard to enjoy those years of retirement. Those are your years of fun, discovery, curiosity and spoiling yourself a little.

Here is an interesting data for you: in 2020 ATO found that for the 2.9mil Australians aged over 70, only 540,000 had more that $1,000 in super, around 310,000 had more than $200,000 and only 180,000 had more than $500,000 and most of those high balances were in SMSF. I am not surprised about those findings.

However, out of those mentioned 90% who passed away, died with no super left in their accounts.

Having said that, in 2020 around 35,000 individuals had more than $3mil in superannuation and 90% of those had SMSF. Treasury estimates that number to grow to 80,000 by 2025-26.

I talked about this issue in: Extra new tax in superannuation – this change will affect more people than you are told. This appears to be quite a controversial topic, so read it and let me know your thoughts.

What does the increase of our superannuation savings mean?

- More and more people retire with more private money than in the past

- Consequently, an average retirement income is also higher and that improves the quality of retirement for many

- The number of people eligible for the full Age Pension is decreasing

- The number of people not eligible for Age Pension at all is increasing

Which state in Australia is the wealthiest and with the lowest number of retirees eligible for Age Pension in the age group 66-69 (beginning of Age Pension eligibility):

TAS – 47% – this is the highest number of Age Pension eligibility of retirees out of all states in Australia.

You might be surprised that ACT is the state with the lowest number of Age Pension recipients, but this is due to a high number of government employment that provides a defined benefit pensions, that takes those people out of the Age Pension system due to high super pension payments.

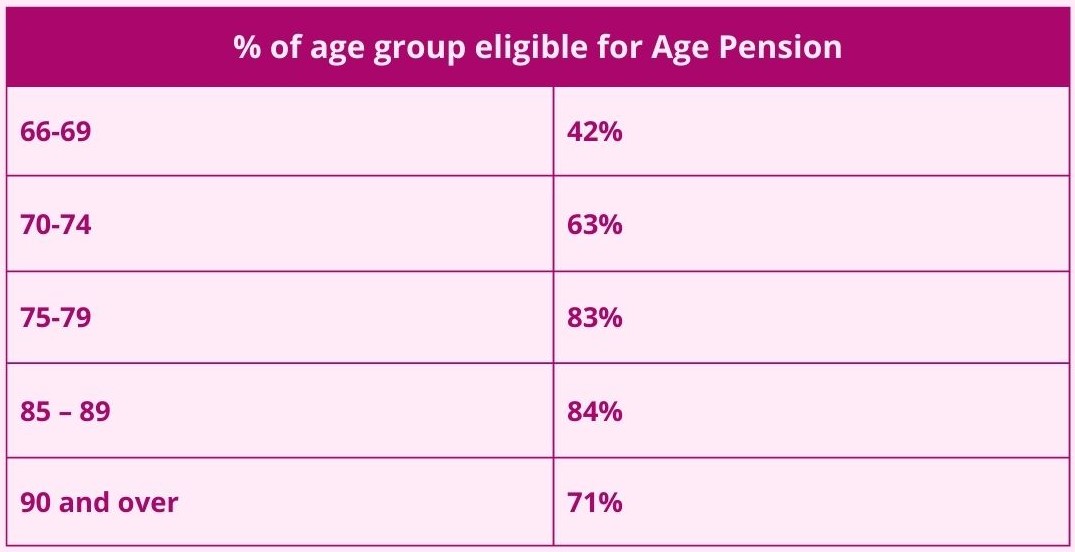

Let’s now have a look at Age Pension eligibility based on age:

As you can see from the table, at the beginning of retirement less than 50% of retires are eligible for Age Pension with numbers increasing up to 84% at the age of 90.

Also, for most retirees the Age Pension payments increase the older they get.

That indicates that people spend their savings, their super and pension, and it is good to see that Age Pension provides a safety net in retirement, if the assets reduce in value over time.

But then pass the age of 90 the number of people eligible for age Pension decreases.

Why is that?

Well, my guess is that having a greater wealth extends the life expectancy, improves quality of life and allows for a better medical care.

The other reason is that most people pass the age of 90 are singles and the rules of Age Pension eligibility are much tighter, especially the Asset Test.

And this is why every stage of your life needs to be planned correctly if you wish to keep your Age Pension intact.

To learn how to set up your savings for the best retirement you can have, visit my website AboutRetirement.com.au where you can find lots of articles, videos and other resources all devoted to the preparation for retirement.

If you need advice how to set yourself up financially for the best retirement you could have, how to organise your income streams correctly, increase your eligibility for any government benefits such as Age Pension, or how deal with tax when selling assets prior or during the retirement or any other financial issue, just book a consultation meeting with me through the website.

By: Katherine Isbrandt CFP®

Money Strategist & Retirement Planner

Principal of About Retirement