Age Pension improvements – empty promises

This week is a very special week for me.

Not only I’ve just had my birthday, sorry – but I am not telling my age, that would be un-female. And I am just like most women very sensitive to this subject.

All my friends are telling me, Katherine it is just a number, but however I look at this, it is becoming a big number, so my solutions is just not to think about it.

That doesn’t mean I am not preparing myself for the time when I decide to no longer work, oh no.

I am a financial planner at heart after all, and whatever strategies I advise to my clients, I apply myself to my own financial set up.

In my personal planning I am providing myself with the same type of an advice that I give to clients, but in my mind, I just pretend it is a plan for someone else, hence I don’t have any emotional attachment to the age or to the money.

Anyway, as I said it is my birthday week and you would not guess what present I’ve already received exactly for my birthday.

This YouTube channel has just hit 1 million views. Exactly on my birthday. What a present, what a spectacular outcome.

And I don’t mean for me or for this channel, although this is a reason enough to celebrate.

No, what I mean is that if my private channel, that is not a representing a big corporation, that does not have millions of dollars to spend on marketing or to buy views, increased to this size, it just goes to show how much financial and retirement planning information and advice is needed by Australians preparing for retirement, how much people are taking care of their money, their savings, their financial solutions for a better future.

This is what makes me happy, proud and thankful for the outcome of this channel.

And to receive confirmation of what I would consider a success of this channel, because this is exactly what I set out to achieve as a goal, exactly on my birthday is very enjoyable indeed.

So thank you for watching, thank you for learning and for trying to improve your life for a better retirement.

And if my knowledge and experience contributed to a better outcome for you, I am most happy and grateful that I could have been a small part of your retirement financial success.

Today’s topic is partially a good news and partially a bit deceiving, because if you dig below the surface to really understand if that change supposedly beneficial, is really so beneficial as the government want you to believe, you will be surprised.

So today we will be talking about the Age Pension changes and increases, and we will check how beneficial they really are.

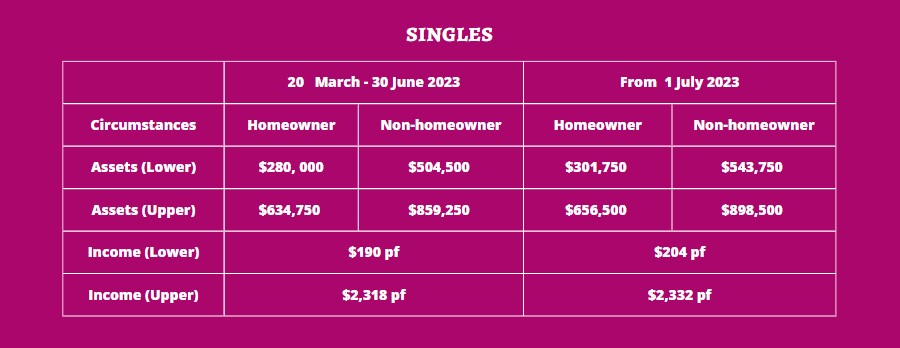

Let’s check this table:

There is no change in the level of payments you are receiving from the following:

What is changing however are thresholds for those payments that were introduced on 1st July 2023:

To be eligible for the full Age Pension:

- As a single homeowner, the level of assets that you can have under the Assets Test has increased from $280,000 up to $301,750

- As a single nom-homeowner, the level of assets that you can have under the Assets Test has increased from $504,500 up to $543,750

The Age Pension will cut out now:

- For a single homeowner the level of asset you can have before the cut off point has increased from $634,750 up to $656,500

- And for a single non-homeowner, the level of asset before you lose Age Pension has increased from $859,250 up to $898,500

That’s great, you might say, but just wait for the reveal of the real news.

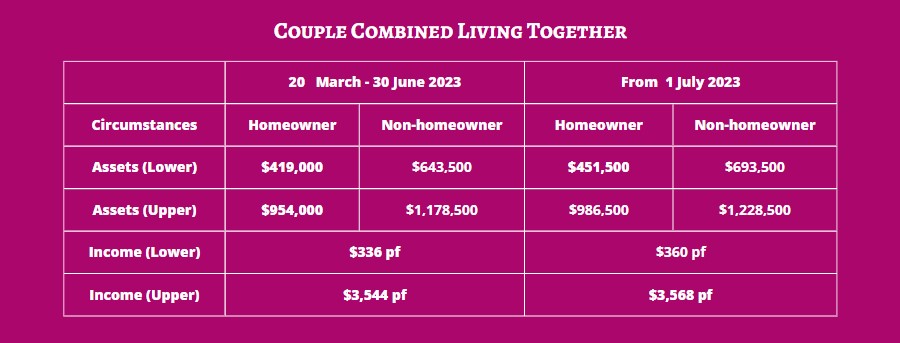

Similar increases have been introduced for couples:

- Homeowners now can have up to $451,500 and still be eligible for the full Age Pension payment

- Non-homeowners up to $693,500

And a couple will lose Age Pension if your total assets are above:

- $986,500 for homeowners

- $1,228,500 for non-homeowners.

Sounds like a very good news, doesn’t it.

So let’s put those numbers to the test:

Jane is a single homeowner with $301,750 in her bank account, which is the maximum allowable value of assets she can have to be eligible for the full Age Pension under the Assets Test increase I’ve just explained.

Under the Income Test however, she is not eligible for the full Age Pension payment, but in fact her Age Pension will be reduced by $139.00 annually. Not much maybe, but this just goes to show how careful one has to be in accepting those asset threshold increases.

Tom is also a single non- homeowner, and he has $543,750 in assets, therefore the maximum allowable under the Assets Test for full Age Pension eligibility. Under the Income Test, his Age Pension outcome is even worse then Jane’s, his Age Pension will be reduced by $2,861pa, therefore $110pf.

Let’s see now if the same issue applies to couples.

Margaret & Steve are a couple, homeowners with exactly $451,500. And under the Assets Test and well as Income Test, they are eligible for the full Age Pension

Eva and Mathew are also a couple, but non-homeowners, with assets exactly of $693,500. Well, their Age Pension is reduced under the Income Test by $2,120 combined between them both.

So as you can see it is essential to check where you are and not to jump into conclusions too fast.

You really need to check both tests before you know exactly what is your Age Pension entitlement.

One thing of caution is that our current Deeming Rates are still very low, they are from the Covid time, before we started experiencing increase of inflation and interest rates. The reason why you have those low rates of deepening is because that was the electoral promise from Albanese when he won election. However this promise to keep deeming rates low will only run till 1st of July 2024, so just short of a year. Then the rate of deeming rates will be changed and set up according with the cash rates in Australia, which currently is much higher due to high level of inflation.

The unfortunate flow on effect will be reduction or even loss of Age Pension for retirees that have assets close to those cut off threshold, so my recommendation is to get advice while you have the time. You have 10 months left to organised yourself and your money to maximise that Age Pension benefit, before it is too late and you lose the benefit due to higher deeming rates.

Are you in this situation? Are you close to those threshold limits, just book a meeting with me..

by: Katherine Isbrandt CFP®

Money Strategist & Retirement Planner

Principal of About Retirement